Blockchain is Immutable, Except when it Isn’t

One of the major talking point of Web3, its prerequisite blockchain, and their native cryptocurrencies, is that blockchains are immutable, permanent records. They do not change, and therefore the information on them cannot be altered. This is generally presented with the implication that modifying a ledger is fraudulent and bad. This point of view does not consider the reality that fraudulent information can be entered into a ledger, and therefore the utility of modifying a ledger is to correct it.

For example, credit card companies have the power to reverse fraudulent transactions made by criminals. While new tech advocates may assume that all transactions are motivated by good will, and any desire to modify the ledger is based on bad will, life in the real world more often indicates that some transactions are motivated by bad will, and the need to modify the ledger is in the service of good will.

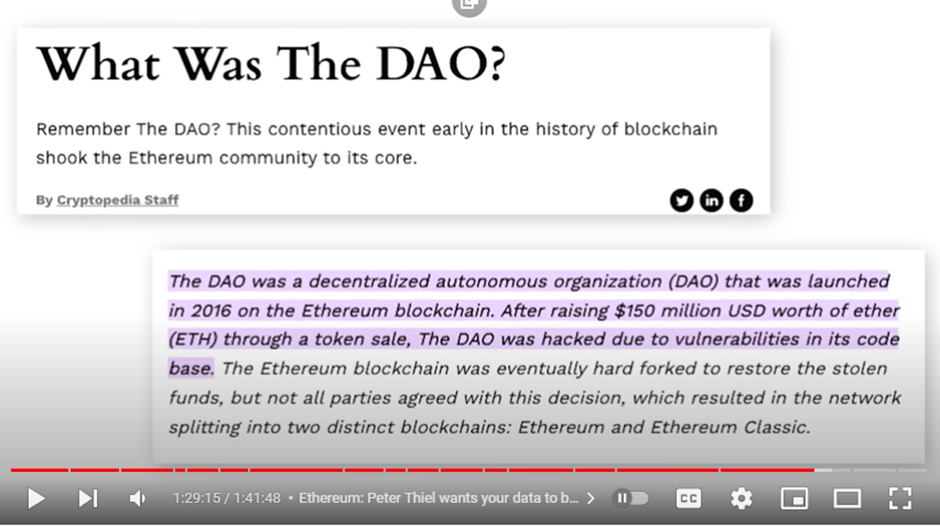

Rather than going back and editing the blockchain, what organisations who have de facto centralised control over a blockchain do is to hard fork it. Case in point is the Ethereum DAO circa 2016.

As a result of someone hacking the DAO, moving 1/3 of the money it had raised to another wallet, and putting the credibility of Ethereum at serious risk, those with power over Ethereum chose to roll back the clock, so that those transactions were effectively rolled back. “Because all the talk about ‘decentralization’ is a myth. It’s just words. At the end of the day the guys in charge, the guys who built the system to serve their interests, are still in charge and keep a kill switch in their back pocket. Crypto is barely a decade old and organizations deemed too big to fail already exist.” (Dan Olson, Folding Ideas “Line Goes Up – The Problem With NFTs”, 21 JAN 2022)

Another case is when in June of 2022 the operators of the Solend DeFi protocol tried to modify a relevant Solend smart contract to prevent the automatic liquidation of the assets of the single largest trader on that platform. The organisers of this DAO needed emergency powers to make this smart contract modification. Patrick Boyle says that the takeaway from this situation is that “most of the time code is law, except when you don’t like the outcome, then you make something else up quickly.” (Patrick Boyle, “Crypto Utopia Cracking?”, 25 JUN 2022)

There is a corollary to this in tractional financial markets where stock or comodities exchanges roll back a day’s transactions because the day sees exceptional high or low prices, and this in turn threatens to drive market participants out of business.

A $50 Million Hack Just Showed That the DAO Was All Too Human, Wired 18 JUN 2016

www.wired.com/2016/06/50-million-hack-just-showed-dao-human/

“By Saturday, 18th June, the attacker managed to drain more than 3.6m ether into a “child DAO” that has the same structure as The DAO. The price of ether dropped from over $20 to under $13.”

“Understanding The DAO Attack”, Coindesk, 25 JUN 2016 (updated 19 AUG 2022)

www.coindesk.com/learn/2016/06/25/understanding-the-dao-attack/

“What Was The DAO?”, Cryptopedia, 16 MAR 2022

www.gemini.com/cryptopedia/the-dao-hack-makerdao